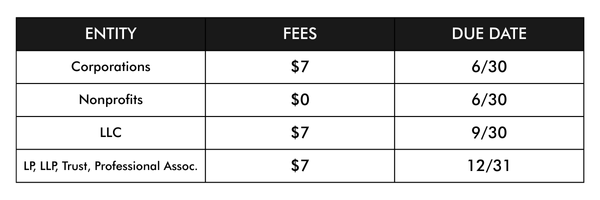

| Hello all, Starting in 2025, most businesses registered in the state of Pennsylvania will be required to file an Annual Report. The state has recommended filing online at https://file.dos.pa.gov/ The PA Department of State will be mailing out postcard reminders to the registered office address of required filers at least two months prior to the report due date. What information is required? Business name, jurisdiction of formation, address, name of one governor (director, member, partner, etc), names and titles of principal officers (if any), and entity number issued by the Pennsylvania Department of State. Who Needs to File? · Domestic business corporations · Domestic nonprofit corporations · Domestic limited liability (general) partnerships · Domestic electing partnerships that are not limited partnerships · Domestic limited partnerships (including limited liability limited partnerships) · Domestic limited liability companies · Domestic professional associations · Domestic business trusts · All registered foreign associations Due Dates & Fees |

|

| What happens if you don’t file? Starting with failure to file Annual reports for 2027, domestic associations face administrative dissolution or cancellation, and foreign associations face administrative termination of registration as well as loss of protection of its name. Please let us know if you have any questions. We are happy to help! Erin |